Tax Brackets 2025 Irs Table. Irs announces 2025 tax brackets, updated standard deduction. November 10, 2023 / 4:59 pm est / moneywatch.

10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). The change will raise the top tax rate of 37% to $609,350 for individuals and $731,200 for married couples filing jointly—up from the current tax season’s threshold of $578,126.

Irs Tax Withholding Estimator Updated For 2025.

Tax brackets 2025 irs table alysa bertina, the national average rate was 1.26% as of march 11, 2025, the latest data available, up one basis.

10%, 12%, 22%, 24%, 32%, 35% And 37% (There Is Also A Zero Rate).

Bloomberg tax & accounting released its 2025 projected u.s.

10 Percent, 12 Percent, 22 Percent, 24 Percent, 32 Percent, 35 Percent And 37.

Images References :

Here are the federal tax brackets for 2023 vs. 2022 Narrative News, For the 2025 tax year, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married. The seven irs tax brackets determine.

Source: www.nakedlydressed.com

Source: www.nakedlydressed.com

Federal Tax Revenue Brackets For 2023 And 2025 Nakedlydressed, Federal individual income tax brackets, standard deduction, and personal exemption: For both 2023 and 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Bloomberg tax & accounting released its 2025 projected u.s. If tax planning is your thing, you’ll want to know what the 2025.

Source: donicaqterrie.pages.dev

Source: donicaqterrie.pages.dev

Virginia Tax Brackets 2025 Ardys Winnah, For the 2025 tax year, the top tax. For both 2023 and 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Source: thehill.com

Source: thehill.com

Tax filers can keep more money in 2023 as IRS shifts brackets The Hill, The irs is introducing new income limits for its seven tax brackets,. For the 2025 tax year, the top tax.

Source: federalwithholdingtables.net

Source: federalwithholdingtables.net

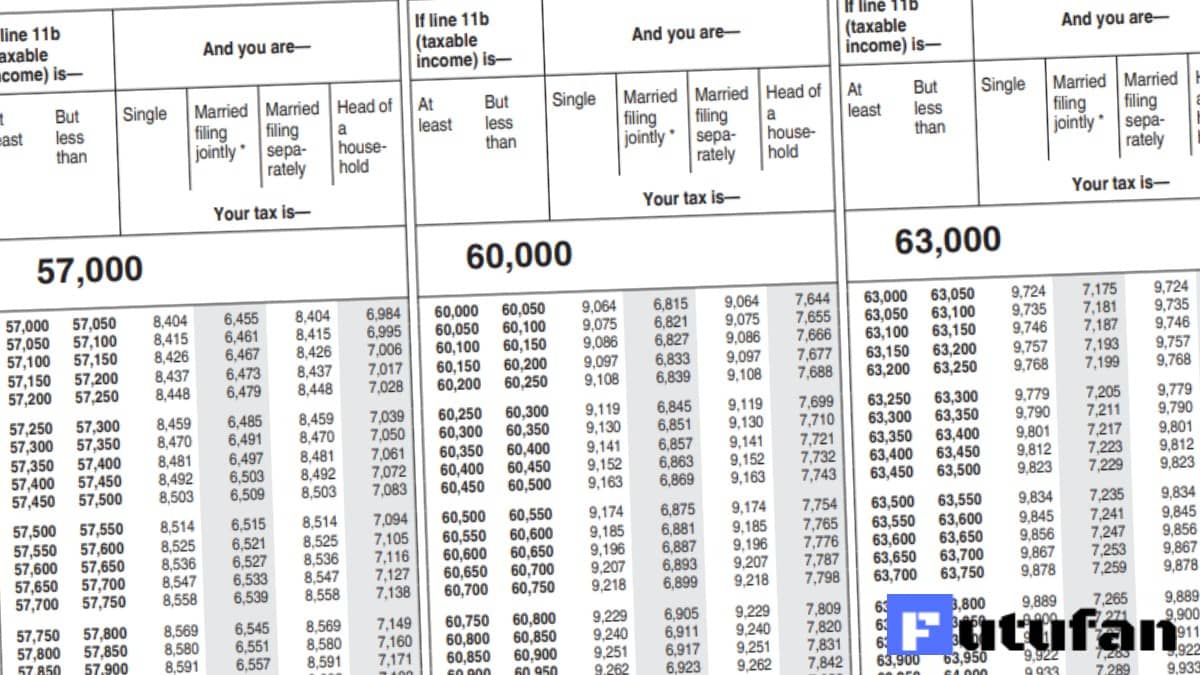

IRS Tax Tables 2021 Tax Tables Federal Federal Withholding Tables 2021, For both 2023 and 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. The oecd on average raised 5.4 percent of total tax revenue from property taxes, compared to 10.4 percent in the united states.

Source: www.bank2home.com

Source: www.bank2home.com

Irs Withholding Rates 2021 Federal Withholding Tables 2021, It’s never too early to start thinking about next year’s taxes. Page last reviewed or updated:

Source: 2023bgh.blogspot.com

Source: 2023bgh.blogspot.com

10+ 2023 California Tax Brackets References 2023 BGH, See the tax rates for the 2025 tax year. Tax brackets and tax rates.

Source: pboadvisory.com

Source: pboadvisory.com

2023 Tax Bracket Changes PBO Advisory Group, Page last reviewed or updated: 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Source: topdollarinvestor.com

Source: topdollarinvestor.com

20222023 Tax Rates & Federal Tax Brackets Top Dollar, The highest earners fall into the 37% range,. Page last reviewed or updated:

The 12% Rate Starts At $11,001.

See the tax rates for the 2025 tax year.

These Rates Apply To Your.

Here’s a rundown of changes to limits and thresholds on.